Section 179 Tax Benefits

Which Chevrolet Models Qualify for Section 179?

Upgrade your business with a reliable work vehicle at Country Chevrolet and save with Section 179 tax deductions. Our team can help you find the right vehicles to add to your fleet and ensure you get the best deal possible. Learn more about Section 179 small business benefits and how it can apply to your next business-use vehicle purchase.

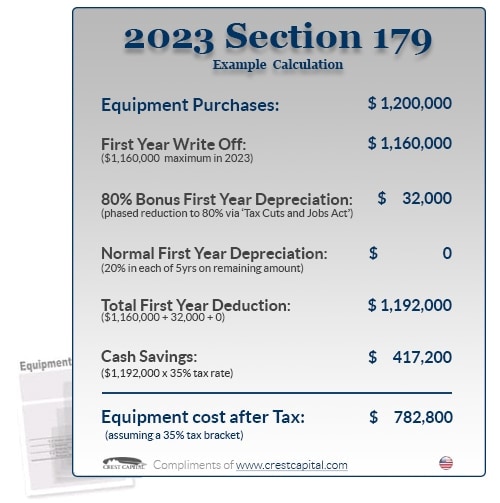

Here is an updated example of Section 179 at work during the 2023 tax year.

What is Section 179?

Section 179 is a rule in the IRS tax code that allows small to medium business owners to deduct the purchase of equipment for their business from their total tax liability. New rules allow businesses to deduct the full purchase amount for 2023, allowing them to invest and grow. All new and used vehicles at Country Chevrolet qualify for at least a partial deduction. Limits are based on vehicle weights or modifications made for specific work purposes like police, emergency medical services, heavy-duty construction, hearses, and more. There is also a total spending cap to ensure Section 179 remains a small business benefit:

$1,160,000

This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2023, the equipment must be financed or purchased and put into service between January 1, 2023 and the end of the day on December 31, 2023.

$4,050,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true "small business tax incentive" (because larger businesses that spend more than $3,780,000 on equipment won't get the deduction.)

80%

Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. The Bonus Depreciation is available for both new and used equipment.

The above is an overall, "birds-eye" view of the Section 179 Deduction for 2023. For more details on limits and qualifying equipment, as well as Section 179 Qualified Financing, please read this entire website carefully. We will also make sure to update this page if the limits change.

Section 179 Eligibility by Weight

Section 179 deductions are incredibly flexible, as all physical equipment, including furniture, office supplies, vehicles, etc., qualify as a deductible business expense. There are caps in place to ensure small businesses benefit the most and that the equipment is mostly for business use. Eligible vehicles must be used for at least 50% business use and placed into service by December 31, 2023, to qualify for the deduction in the 2023 tax year. Deduction caps change yearly, and bonus depreciation is currently being phased out and set for 80% of the purchase price for 2023. Here are the deduction caps based on vehicle weight:

Save On New and Used GM Models for Your Business at Country Buick GMC of Leesburg

Thanks to the flexibility of Section 179, any new or used vehicle on our lot qualifies for at least a partial deduction. Contact our team at Country Buick GMC of Leesburg for more information on how to save on your next fleet or commercial work vehicle.

How Can We Help?

* Indicates a required field

-

Country Chevrolet Inc.

11 E Lee Hwy

Warrenton, VA 20186

- Sales: (540) 216-0479

AdChoices

AdChoices